They definitely don't consider playing it repeatedly, knowing that every turn they take would increase the chances of catastrophe.

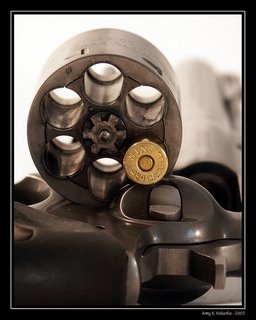

So why is the Florida Legislature using Russian Roulette as a model for our property insurance?

We have two levels of government run insurance covering hundreds of billions of dollars worth of property, both of them are charging below market rates, and both of them have the power to charge you taxes if they need more money. Every year this goes on drives more private insurers out of the state, increasing the number of properties insured by Citizens and therefore also increasing the risk we are all bearing...

Think Florida has a housing bubble and a bad unemployment rate now?

Just. You. Wait.Yes, that's the real danger: both Citizens and the Cat Fund are government agencies, and have the power to levy assessments on nearly every insurance policy in Florida. That would include not just property insurance, but also car and motorcycle insurance, renter's insurance, business insurance, boat insurance, etc. Floridians are still paying assessments to cover the costs from the 2004-2005 hurricanes.

Florida's unemployment rate has made some steady improvements under Governor Scott, but no amount of regulatory reform could counter the devastating impact that skyrocketing insurance costs would have on our economy. Worried about the value of your home now? Just imagine trying to sell it if the cost of property insurance doubles or triples!

Unless we figure out a way to move Florida to some other part of the planet, we are always going to be in the path of hurricanes, and it is only a matter of time before we have a major storm again. Former Governor/former Republican Charlie Crist may have created this problem, but the blame now lies with our legislators who have let year after year pass without taking action.

Christian Cámara wrote a post yesterday on his blog, Reaganista (which you really should be reading), about how Congress had managed to pass much-needed reforms to the national flood insurance program, and asking why our own Legislature seems unwilling to take similar steps:

Last week Congress passed legislation that would not only extend the National Flood Insurance Program (NFIP) for five more years, but would also allow a series of rate hikes to make the program more financially sound and offset some of its debt...

Thankfully, congress made the right decision in reauthorizing NFIP, as observers believed it would. What is surprising, however, is that a divided congress would also do something fiscally responsible despite it being politically unpopular...

So if a divided Congress and a Democrat president facing reelection in the middle of a bad economy can agree to enact fiscally responsible reforms to the NFIP, why can’t the Republican-dominated Florida Legislature come together and send a bill to the Republican governor that will do the same with Citizens to avert an economic disaster?

There are some signs of hope. Recently, twenty-five legislators signed their names to a letter, endorsing a proposal to raise premiums for new Citizens customers: State Senators Don Gaetz, Alan Hays, and Garret Richter, and State Representatives Jim Boyd, Ben Albritton, Dennis Baxley, Jason Brodeur, Daniel Davis, Brad Drake, Eric Eisnaugle, Matt Gaetz, Bill Hager, Mike Horner, Charles McBurney, Larry Metz, Bryan Nelson, Kathleen Passidomo, Scott Plakon, Elizabeth Porter, Stephen Precourt, Lake Ray, Kelly Stargel, John Tobia, Mike Weinstein, and Ritch Workman. State Representative Jimmy Patronis has also expressed support for a rate increase to improve Citizens' solvency.

Please contact your State Senator and State Representative today, and ask them to pass meaningful property insurance reforms as soon as possible. Let them know that this is a priority for the people of Florida.

A lot of work happens in the months before the legislative sessions begin, and legislators will be deciding what bills they want to sponsor very soon. Also, every single member of the Florida House is up for reelection every two years, and because of redistricting, every member of the Florida Senate is up for reelection this year too. Let your representatives know that if they want your vote, you expect them to protect our state's economic future.

Further reading:

Reaganista | Commentary on Wall Street Journal Editorial "Waiting for Hurricane Charlie (Crist)"

Palm Beach Post | Head off 'economic disaster'

Palm Beach Post | Head off 'economic disaster'

The Heartland Institute | Heartland Criticizes Legislature’s Inaction on Meaningful Property Insurance Reform: ‘An Epic Disappointment’

Tallahassee Democrat | It's time Floridians pay the true cost of insurance

I had no idea the situation was this bad. What happens if a storm hits this summer before our representatives go back to Tallahassee? We're screwed!

ReplyDelete